Unrealized gains and losses. If you pay or create invoices in a foreign currency youll need to convert the invoice to your home currency when you log the invoice and again when it is settled.

Forex Loss Income Tax

For example lets say your home currency is usd and you post an invoice for 100 gbp to a british customer.

Foreign currency gain. The value of the foreign currency when converted to the local currency of the seller will vary depending on the prevailing exchange rate trade weighted exchange rate the trade weighted exchange rate ! is a. What is foreign exchange gainloss. A foreign exchange gainloss occurs when a person sells goods and services in a foreign currency.

Foreign currency translation is used to convert the results of a parent companys foreign subsidiaries to its reporting currency. Where the exchange rate moves between the two conversion dates you record the difference as a foreign currency gain or loss. Foreign currency bank accounts periods from 6 april 2012.

Ubersetzungen fur foreign currency gain im englisch deutsch worterbuch von pons onlineforeign currency gain. Except as provided in regulations a taxpayer may elect to treat any foreign currency gain or loss attributable to a forward contract a futures contract or option described in subsection c1biii which is a capital asset in the hands of the taxpayer and which is not a part of a straddle within the meaning of section 1092c without. Although accounting for foreign currency matters has al! ways been a challenging area globalization has led to increase! d complexities with respect to the application of this guidance.

988 treats most but not all gains and losses from foreign currency transactions as ordinary in character. Depending on the taxpayers circumstances this treatment can be favorable or otherwise. This is a key part of the financial statement consolidation process.

A gain or loss is unrealized if the invoice has not been paid by the end of the accounting period. This guide begins with a summary of the overall framework for accounting for foreign currency matters. Viele ubersetzte beispielsatze mit foreign currency gains deutsch englisch worterbuch und suchmaschine fur millionen von deutsch ubersetzungen.

Foreign Currency Gains And Losses Zuora

Foreign Currency Gains And Losses Zuora

:max_bytes(150000):strip_icc()/GettyImages-676907197-5a0ffb3613f1290037f0418f.jpg) Forex Trading Basics

Forex Trading Basics

Accounting For Foreign Currency Ppt Video Online Download

Accounting For Foreign Currency Ppt Video Online Download

Foreign Currency Valuation Explained With Example Tech Concept Hub

Confluence Mobile Attache Help Centre

Confluence Mobile Attache Help Centre

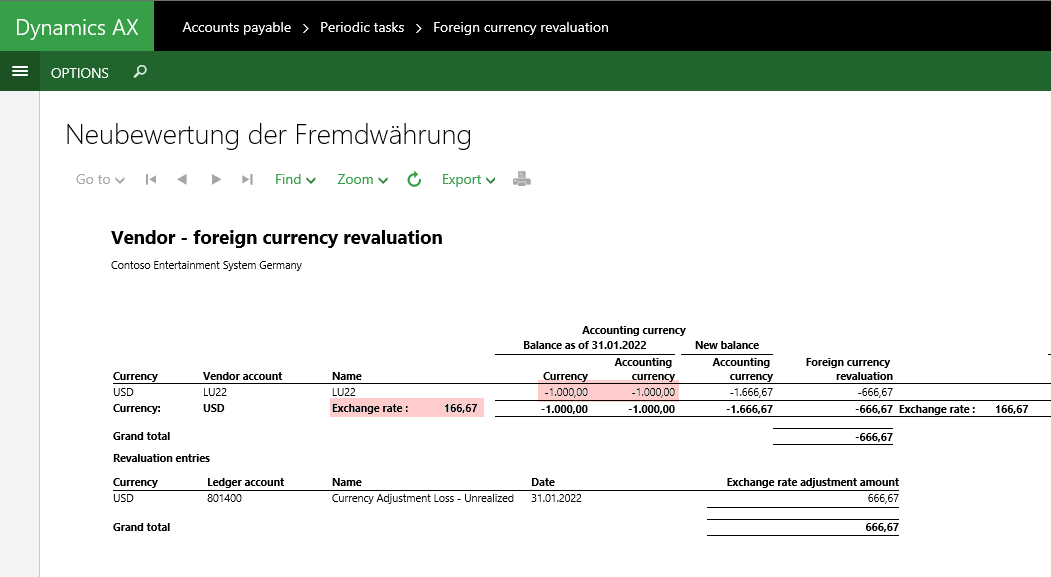

Foreign Currency Revaluation Finance And Operations Community

Foreign Currency Revaluation Finance And Operations Community

Foreign Currency Slideshow Ppt Download

Foreign Currency Slideshow Ppt Download

Unrealized Currency Gains Experts In Quickbooks Consulting

Multiple Currency Accounting In Gnucash

Multiple Currency Accounting In Gnucash

How Do You Realise A Foreign Currency Fx Gain Or Loss Non Zero

How Do You Realise A Foreign Currency Fx Gain Or Loss Non Zero

How To Make Journal Entry For Unadjusted Forex Gain Loss

How To Make Journal Entry For Unadjusted Forex Gain Loss

Realized Or Unrealized Gain Loss For Taxation Of Foreign Currency

Realized Or Unrealized Gain Loss For Taxation Of Foreign Currency

Multi Currency Tips And Tricks Quickbooks

Multi Currency Tips And Tricks Quickbooks

Intraday Foreign Exchange Rates Now On Sharesight Sharesight

Intraday Foreign Exchange Rates Now On Sharesight Sharesight

Managing Foreign Currency Exchange Gains Losses In Sap Business On! e

Managing Foreign Currency Exchange Gains Losses In Sap Business On! e

0 Response to "Foreign Currency Gain"

Posting Komentar