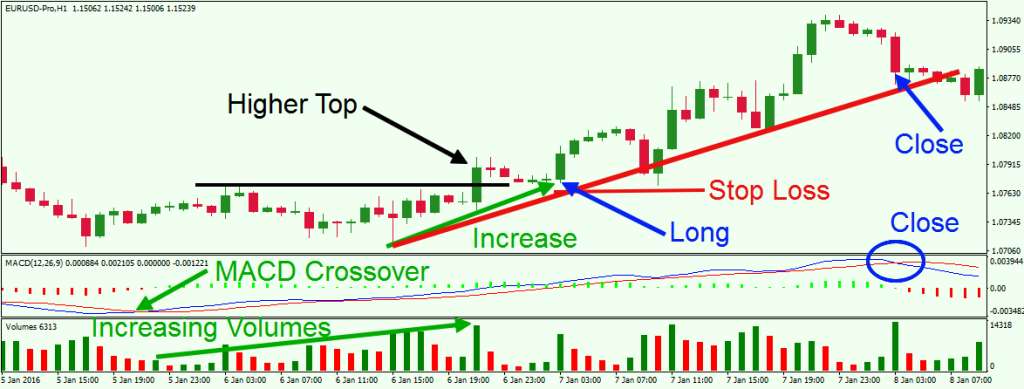

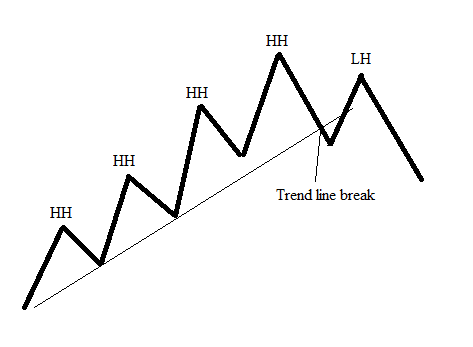

By finding trading opportunities in the overall trend you can still have great risk. When a major trend line is broken a reversal may be in effect.

How To Identify And Trade With The Trend In Forex Forex Training Group

How To Identify And Trade With The Trend In Forex Forex Training Group

Identifying trend reversals with smas the most commonly use moving averages are 20 50 100 and 200.

How to identify forex trend reversal. A reversal is when the trend direction changes. ! Theres a huge choice of different types and styles to choose from. By using this technical tool in conjunction with candlestick chart patterns discussed earlier a forex trader may be able to get a high probability of a reversal.

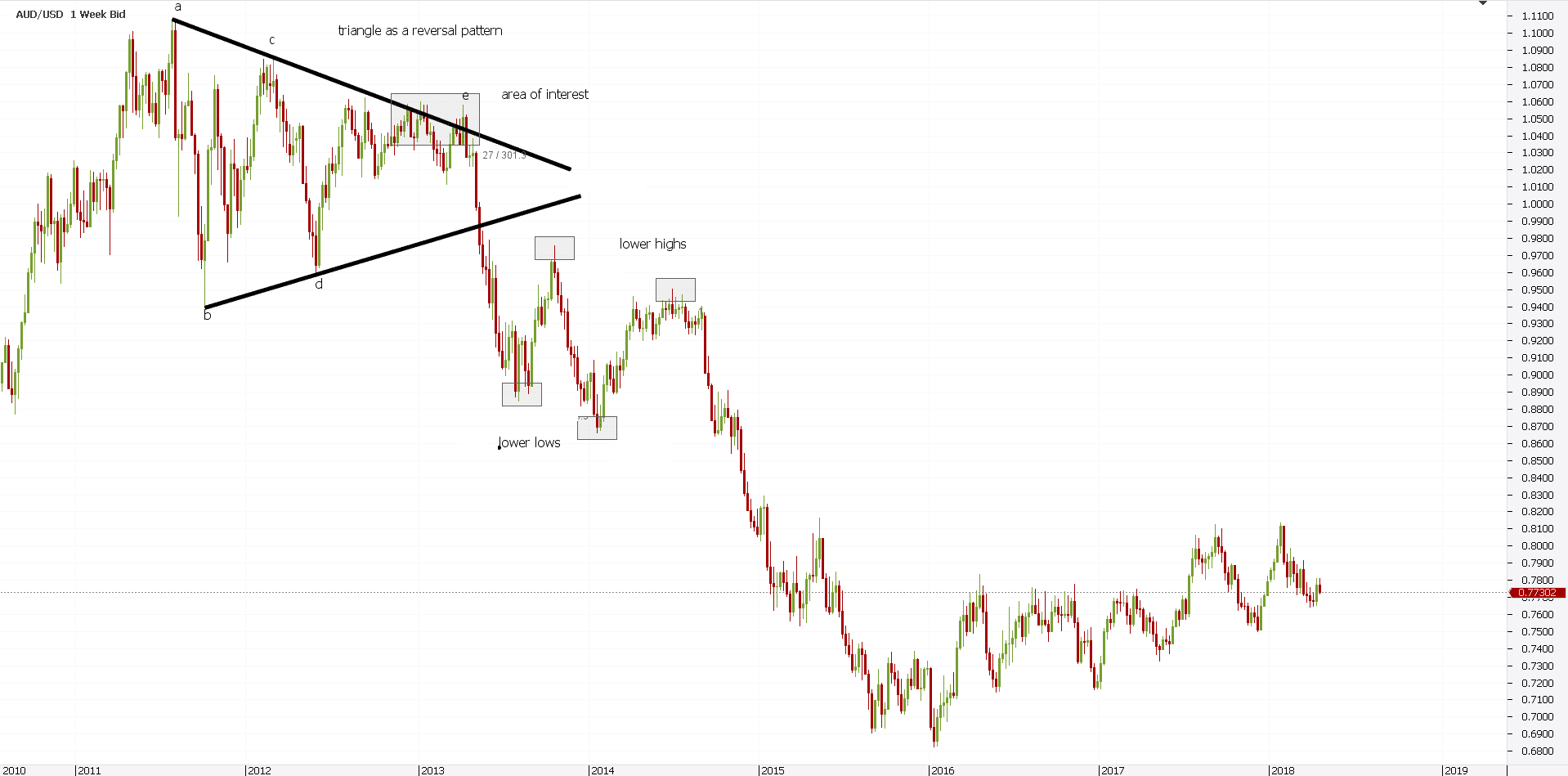

Trend reversals happen when a downtrend changes into an uptrend or vice versa. Capturing trending movements in a stock or other asset can be lucrative yet getting caught in a reversal is what most trend traders fear. Generally two mas per chart are enough but depending on a strategy more or fewer could be used.

If you can. In the above example the forex trader failed to recognize the difference between a retracement and a reversal. But ultimately theres not a huge difference between them all and picking one over another isnt going impact the end result very much.

Therefore knowing how to identify trend reversals and corrections increases your chances of success and allows to benefit f! rom the market more. The last method is to use trend lines. It! s a bit like a runner buying a new pair of trainers before a race.

As a trend matures it will move into a distribution stage where both buyers and sellers are in equilibrium thus looking like a range market. Even the strongest trending markets sometimes become reversed out of the blue. Reading people opinions of how to identify trend reversal in forex right before obtained.

At this point its clear the area of support is an important level as its the last line of defense for the buyers. How to identify trend reversal a break of support resistance area. 19 june atozforex knowing how to follow the trend in forex is often not enough.

It is going to supply you with a considerably comprehension while using positives and disadvantages from it. In this article therefore we will look into how to identify trend reversals. Price tends to reverse after attaining its overbought and oversold levels.

R! eward ratios without needing a rare sequence of event s are for a reversal to occur. If it breaks its pretty much game over for the bulls. Instead of being patient and riding the overall downtrend the trader believed that a reversal was in motion and set a long entry.

While these methods can identify reversals they arent the only way.

Al Brooks Major Trend Reversal Forex Software

Al Brooks Major Trend Reversal Forex Software

5 Ways To Identify The Direction Of The Trend T! radeciety Trading

5 Ways To Identify The Direction Of The Trend T! radeciety Trading

Recognize Reversal And Retracement

![]() 9 Tools That Trend Traders Can Use To Find Reversals

9 Tools That Trend Traders Can Use To Find Reversals

Ident! ifying Trend Reversals

How To Identify Trend Reversals In Forex Forex Useful

How To Identify Trend Reversals In Forex Forex Useful

Technicals With Etmarkets Use Aroon Indicator To Spot Market

Technicals With Etmarkets Use Aroon Indicator To Spot Market

How To Trade Reversals With The Hanging Man Pattern

How To Trade Reversals With The Hanging Man Pattern

Indicator For Identify Reversal Trend Trend Indicators General

Indicator For Identify Reversal Trend Trend Indicators General

Market Reversals And How To Spot Them

How To Identify Trend Reversals In Forex Forex Useful

How To Identify Trend Reversals In Forex Forex Useful

How To Know If A New Trend Is Starting Or How To Identify Trend

Taking Advantage Of The Trend Reversal Usin! g Price Action

Taking Advantage Of The Trend Reversal Usin! g Price Action

Forex Chart Patterns You Need To Know Daily Price Action

Forex Chart Patterns You Need To Know Daily Price Action

How To Identify Trend Reversal In The Markets

How To Identify Trend Reversal In The Markets

0 Response to "How To Identify Forex Trend Reversal"

Posting Komentar